A 10k Debt Consolidation Loan in the UK helps manage multiple debts by combining them with competitive rates and flexible terms. To qualify, borrowers need a solid credit history and stable income. Repayment periods can be tailored to individual needs, offering relief and flexibility. However, extended repayment may hide overspending issues, so careful assessment and commitment are crucial.

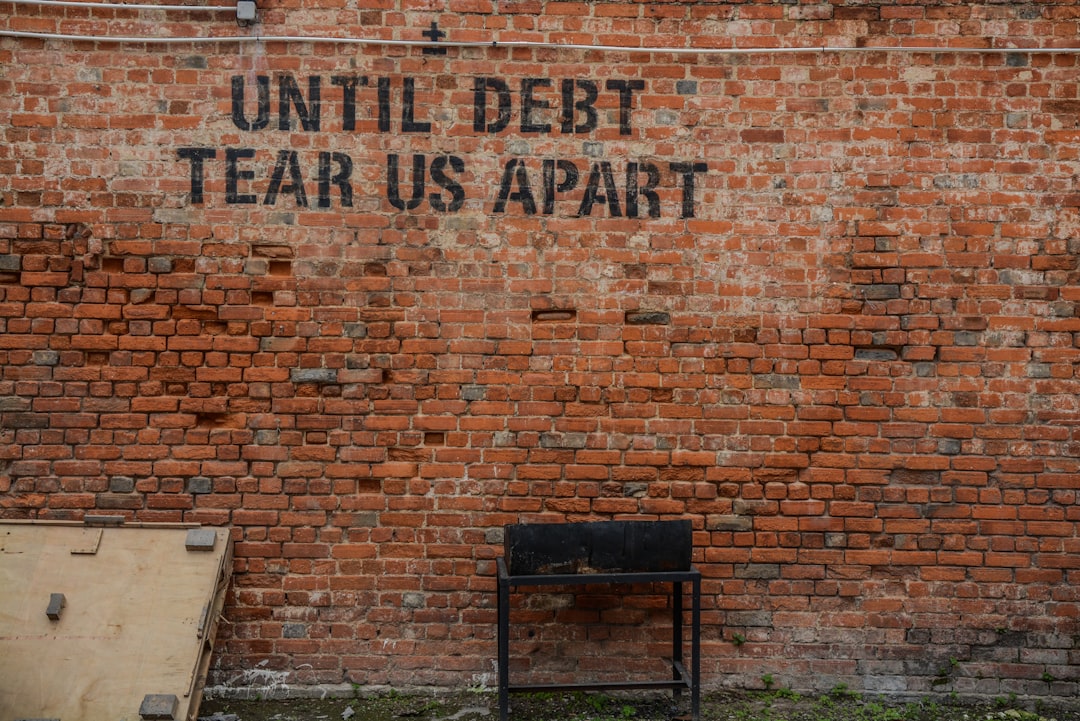

In today’s financial landscape, managing multiple debts can feel like navigating a complex labyrinth. For UK residents burdened by debt, low-interest 10k Debt Consolidation Loans offer a potential game-changer. This article guides you through the ins and outs of these loans, from understanding their appeal to evaluating the benefits and risks. We’ll explore eligibility criteria, unravel flexible repayment terms, and help you decide if a 10k Debt Consolidation Loan is the right move for your financial future.

- Understanding Low-Interest Debt Consolidation Loans UK

- Eligibility Criteria for 10k Debt Consolidation Loan

- How Flexible Repayment Terms Work

- Benefits and Risks of Taking a 10k Debt Consolidation Loan

Understanding Low-Interest Debt Consolidation Loans UK

In the UK, low-interest debt consolidation loans are a popular choice for individuals seeking to simplify their financial obligations. These loans allow borrowers to combine multiple debts into one manageable repayment, significantly reducing monthly outgoings and potential interest charges. A 10k debt consolidation loan, for instance, can cover various types of outstanding debts, including credit cards, store cards, and personal loans, offering a clear path to financial freedom.

This type of loan stands out due to its competitive interest rates and flexible repayment terms. Lenders often tailor the loan structure to suit individual needs, making it accessible to a broad range of borrowers. By consolidating debt, UK residents can bid farewell to the stress and complexity of managing multiple lenders, enjoying instead a streamlined financial journey with potentially lower overall repayments.

Eligibility Criteria for 10k Debt Consolidation Loan

To be eligible for a 10k Debt Consolidation Loan in the UK, borrowers must meet certain criteria set by lenders. Typically, this includes having a good credit history and a steady source of income to ensure repayment. Lenders will assess your financial situation, including your current debts and monthly outgoings, to determine if you can afford the loan repayments without causing further financial strain.

While there’s no one-size-fits-all approach, most lenders look for borrowers with a credit score of 600 or higher. They’ll also consider factors like employment duration and stability, as well as any existing debt management plans or previous consolidations. The key is to demonstrate responsible financial management and the ability to commit to structured repayment terms, which often include flexible options tailored to individual needs.

How Flexible Repayment Terms Work

Flexible repayment terms are a game-changer when it comes to managing your debt, especially with a 10k Debt Consolidation Loan in the UK. This loan type offers borrowers the benefit of tailoring their repayments to suit their financial capabilities and preferences. Instead of adhering to rigid monthly payments, flexible terms allow you to choose the duration over which you want to repay the loan, often ranging from several months to several years.

This flexibility means you can spread out larger debts, like a 10k consolidation loan, into more manageable chunks. Repayments are calculated based on the outstanding balance and your chosen term, ensuring that each payment is proportionate to your financial situation at the time. This approach not only eases the strain of debt but also provides peace of mind, as you can adjust repayments if your income fluctuates or unexpected expenses arise.

Benefits and Risks of Taking a 10k Debt Consolidation Loan

Taking out a 10k Debt Consolidation Loan can be a strategic move for many individuals facing multiple debts. The primary benefit is the consolidation of various debt obligations into one manageable loan, simplifying repayment processes and potentially reducing overall interest costs. This single loan with flexible terms allows borrowers to focus on making consistent payments without the pressure of multiple due dates and varying interest rates.

However, there are risks associated with this approach. If not managed wisely, a 10k Debt Consolidation Loan could extend the repayment period, resulting in paying more in interest over time. Additionally, relying on a loan for debt consolidation might provide temporary relief but does not address the root causes of overspending or impulsive purchasing that led to the debt accumulation. Borrowers should carefully assess their financial situation and ensure they can commit to the loan terms to avoid potential long-term financial strain.

Low-interest debt consolidation loans, particularly the 10k Debt Consolidation Loan option, offer a viable solution for managing personal debt in the UK. By consolidating multiple debts into one with flexible repayment terms, individuals can simplify their financial obligations and potentially save money on interest payments. However, it’s crucial to understand the eligibility criteria and weigh both the benefits and risks before taking out such a loan. Informed decisions will ensure that this strategy serves as a beneficial game-changer in navigating personal finances.