Unemployment and debt? A 10k Debt Consolidation Loan simplifies payments, reduces interest, offers flexible terms based on income, providing financial stability during challenging times. Evaluate rates, repayment options for long-term relief while managing unemployment.

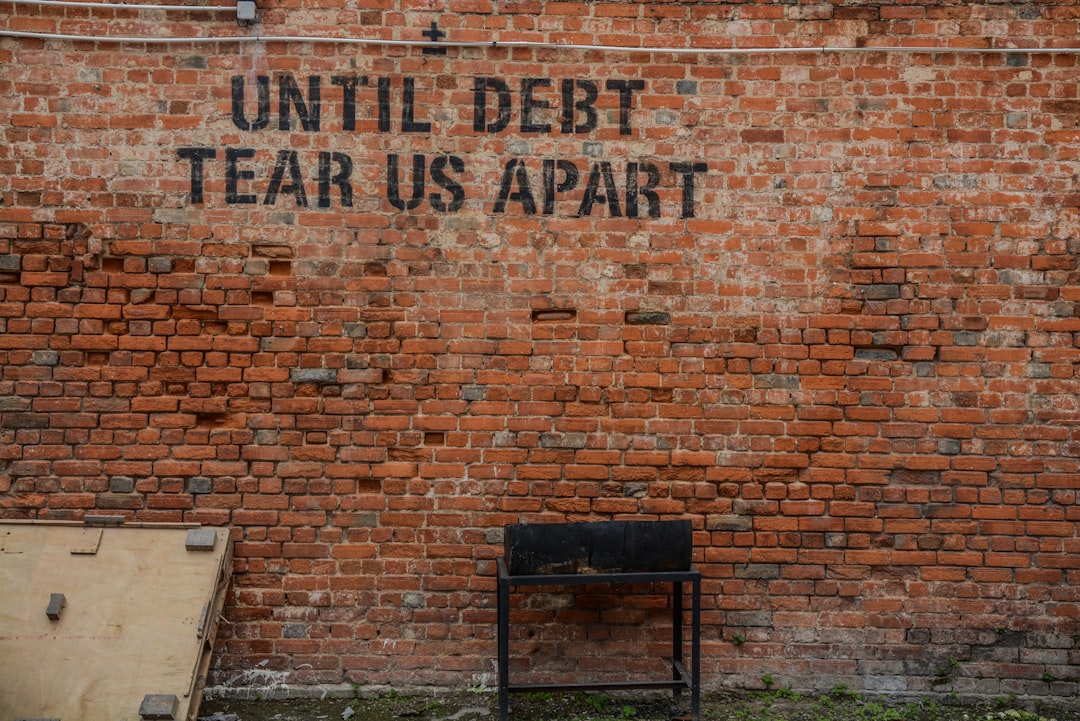

Unemployment can be a challenging period, often piling on debt with limited income. This is where 10K Debt Consolidation Loans step in as a potential lifeline. This article explores how these flexible financing options can help manage unemployment-related debts. We delve into various types of consolidation loans, focusing on the 10K variant, and explain its benefits. Additionally, we guide you through understanding loan terms and conditions to make informed decisions during this financial transition.

- Understanding Unemployment and Debt Consolidation

- Exploring 10K Debt Consolidation Loans

- Flexible Repayment Options Explained

- Benefits of Debt Consolidation for Unemployed Individuals

- Navigating Loan Terms and Conditions

Understanding Unemployment and Debt Consolidation

Unemployment can be a challenging period for anyone, and managing financial obligations becomes even more difficult. In such times, a 10K debt consolidation loan with flexible repayment options can offer much-needed relief. This type of loan allows individuals to combine multiple debts into one manageable payment, making it easier to budget while navigating an uncertain job market.

By consolidating debts, borrowers can potentially reduce their overall interest payments and pay off their loans quicker. Flexible repayment plans often include options for varied payment frequencies and term lengths, catering to the borrower’s income fluctuations during unemployment. This approach provides a strategic way to stabilize finances, offering a sense of control and peace of mind during what could be a stressful period.

Exploring 10K Debt Consolidation Loans

If you’re struggling with unemployment and a mounting debt pile, exploring a 10K Debt Consolidation Loan could be a strategic move towards financial stability. These loans offer a lifeline by combining multiple debts into one manageable repayment, easing the strain of interest charges and multiple due dates. With a 10K loan, you can simplify your finances and potentially save money in the long run.

This type of consolidation loan provides a flexible option for those hit hard by unemployment. The funds can be used to pay off credit cards, personal loans, or other debts, freeing up your budget. Many lenders offer tailored plans with customizable repayment terms, making it easier to fit your loan payments around unpredictable income patterns. This flexibility ensures you maintain control over your finances while working towards debt elimination.

Flexible Repayment Options Explained

Flexible repayment options for debt consolidation loans provide borrowers with tailored plans to manage their debt effectively. This approach allows individuals to pay off their loans in a way that suits their financial capabilities, making it easier to stay on track and avoid defaulting. With these options, you can choose from various structures, such as equal monthly payments or those adjusted based on income fluctuations, ensuring consistent progress toward repayment without the strain of fixed, high installments.

When considering a 10k Debt Consolidation Loan, flexible repayment terms become even more valuable. This loan amount requires careful management, and by spreading out repayments, borrowers can maintain financial stability while gradually reducing their debt burden. These options are particularly beneficial for those facing income changes or unexpected financial setbacks, offering peace of mind and a clearer path to becoming debt-free.

Benefits of Debt Consolidation for Unemployed Individuals

For unemployed individuals struggling with debt, a 10k debt consolidation loan can offer much-needed relief and new financial prospects. One of the primary benefits is the consolidation of multiple debts into a single, more manageable payment. This simplifies budgeting by reducing the administrative burden of tracking several lenders and due dates. Moreover, flexible repayment options allow borrowers to tailor their payments to suit their income, providing a sense of control over their finances during challenging times.

Debt consolidation loans also provide an opportunity for interest rate reduction. By consolidating debts, individuals can often secure a lower overall interest rate than the average on their existing debts, saving money in the long run. This financial leverage can be crucial in helping unemployed borrowers breathe easier and refocus on securing employment while managing their debt effectively.

Navigating Loan Terms and Conditions

When considering a 10k Debt Consolidation Loan, understanding the terms and conditions is crucial. This involves carefully reviewing interest rates, which can vary widely between lenders. Lower interest rates mean less financial strain over time. Additionally, repayment options should be flexible to align with your income and budget, ensuring manageable monthly payments without causing further stress.

Loan terms also dictate how long you’ll take to repay the debt. Longer terms reduce monthly payments but extend the overall cost of the loan. Comparatively shorter terms result in higher monthly outlays but lower interest expenditure. Assessing your financial situation honestly will help choose a term that offers both relief and sustainability, allowing for stability while managing unemployment and debt consolidation.

Unemployment can be a challenging period, but with strategic planning and flexible options like 10K debt consolidation loans, individuals can gain control over their finances. By consolidating debts with manageable repayment terms, unemployed folks can reduce stress, simplify payments, and work towards financial stability. This article has explored the benefits of debt consolidation, offering insights into how to navigate loan terms and utilize 10K debt consolidation loans effectively. Remember that understanding your options is key to making informed decisions during tough times.